Emerge secure, beyond the mask: Redefining digital privacy

Full ownership, maximum control Unparalleled concealment Mitigate identity theft AI-powered transaction reconciliation Spending control, your way

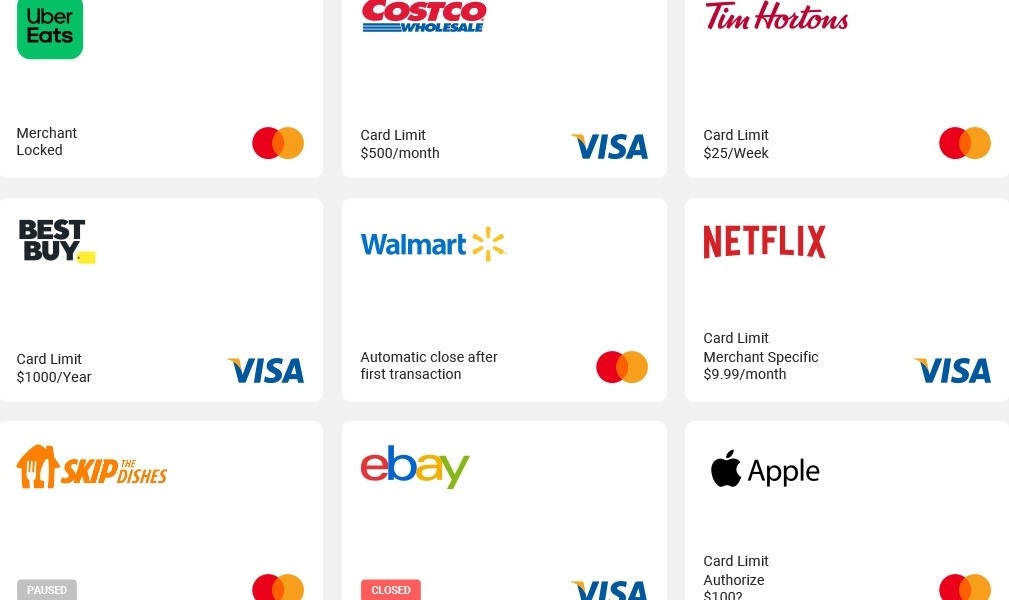

Burner Cards

Conceal ID revolutionizes digital transactions by offering one-time burner cards, effortlessly created to address trust concerns and ensure security and anonymity with a self-destruct feature, eliminating worries about unauthorized charges.

Spending control and set card limit

Conceal ID guarantees transparency and gives you real control in your transactions, allowing you to bid farewell to unexpected charges with customizable spending limits, ensuring financial predictability and preventing overcharges or hidden fees.

AI-powered reconciliation automation

Conceal ID transforms expense management with an AI-enabled credit card reconciliation system, effortlessly handling transactions for seamless reconciliation, and unlocks comprehensive insights into spending patterns with advanced AI-driven reporting.

Merchant-Locked Cards

Conceal ID introduces merchant-locked cards, tailored exclusively to your favorite merchants, ensuring precise transactions and eliminating the risk of unauthorized use for enhanced security.